draftkings sportsbook tax form

IMPORTANT LEGAL NOTICE REGARDING TERMS OF USE OF DRAFTKINGS SPORTSBOOK AND CASINO IMPORTANT. However the income will still be subjected to federal income tax and you will be required to report it on your tax form.

Quick Answer Will Draftkings Sportsbook Send Me A 1099 Cheating Card Game

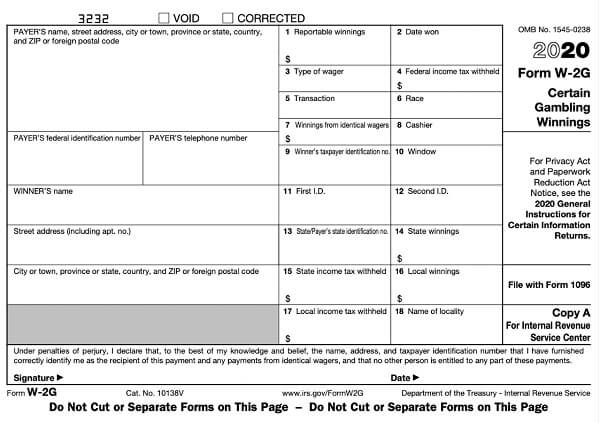

Key tax dates for DraftKings - 2021 Where can I find my DraftKings tax forms documents 1099 W-2G.

. So if youre net 10k but that is after 5k in losses youll need to reportpay income tax on 15k. Gambling winnings are reportable on your Form 1040. We are regulated by the New Jersey Division of Gaming Enforcement as an Internet gaming operator in accordance with the Casino Control Act NJSA.

The only place I see where a 1099-MISC is applicable is Small Business Self employed which is not what my DRAFTKINGS form is from. Create an account online or download our app. If you receive your winnings through PayPal the reporting form may be.

So in this case youd have 1463388 on page 1 of Form 1040 as Other income then on Schedule A youd have gambling losses of 1463388. Forms 1099-MISC and Forms W-2G will become available. How do I update personal information on my tax forms 1099-Misc.

Include any and all income on your tax return that came from a W-2G 1099-K andor 1099-MISC For both DFS and sports betting get the annual transaction history and keep for your records. Why am I being asked to fill out an IRS Form W-9 for DraftKings. How do I update personal information on my tax forms 1099-Misc W-2G for DraftKings.

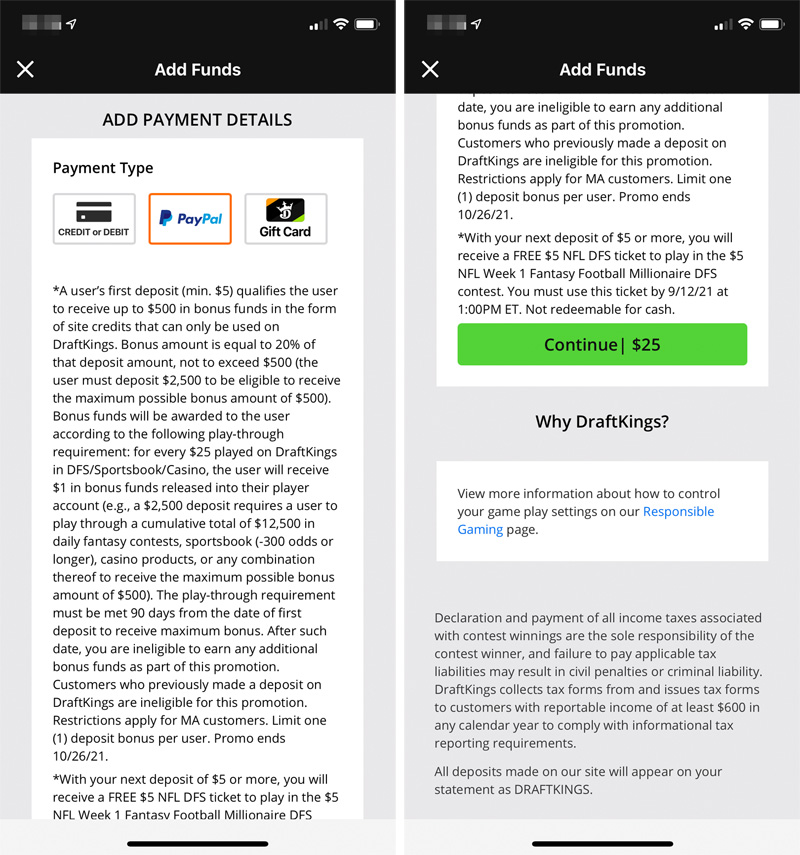

DraftKings W9 Email to Players. If it turns out to be your lucky day and you take home a net profit of 600 or more for the year playing on websites such as DraftKings and FanDuel the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC. Withdrawals Balance at the beginning of the year Deposits Balance at the beginning of the year What DraftKings reports on your 1099 form.

If you dont need to itemize you dont get it. Any losses from wagering are then deductible on Schedule A - Itemized Deductions up to the amount of your winnings. Its not like capital gains where you take your profits minus your losses.

What to do if your 1099 form is not available. You report winnings and then losses are itemized. The first thing to realize is that any winnings are taxable and bettors should include it on a tax return.

W-2G forms are generated automatically when the subscriber meets the reporting criteria. Learn more about the IRSs taxable reporting criteria for gambling winnings and IRS Form W-2G used to report income related to gambling. This is classified as Backup withholding.

To access the Document Center via Sportsbook or Casino app. Why am I being asked to fill out an IRS Form W-9 for DraftKings. Each site should provide a csv.

The 1099-misc form they send you and the irs only shows the net winnings. If you select to receive your winnings via e-wallets such as PayPal the reporting form may be a 1099 -K. We will withhold federal income tax from the winnings if the winnings minus the wager exceed 5000 and the winnings are at least 300 times the wager.

How are daily fantasy sports winnings calculated for tax purposes. Its not necessarily because you didnt show a profit of over 600. They havent forgot you.

If a player meets the reportable thresholds and doesnt have a valid IRS Form W-9 on file with DraftKings DraftKings will withhold 24 of reportable winnings. Some players have reported receiving their DraftKings 1099 forms. Log into the DraftKings Sportsbook or Casino app.

Not total amount won. Just because a taxpayer doesnt receive a tax form it does not make the winnings. Fantasy sports winnings of at least 600 are reported to the IRS.

Andor appropriate tax forms and forms of identification including but not limited to a Drivers License Proof of Residence andor any information relating to paymentdeposit accounts as reasonably requested by DraftKings in. DraftKings uses a formula to calculate your net profits on DraftKings. We wish you the best of luck this tax season and hope 2021 will be a better year.

In order to update your recipient information please use the instructions for changing your personal information. Form W-2G from DraftKings just sharing We will issue a W-2G form each time a player has a payout of 600 or more no reduction for the wagered amount and a return that is 300X the amount wagered. Please advise as to where I input this other income that is not considered gambling however it was gambling winnings.

And its not net. 6 rows Key tax dates for DraftKings - 2021. The Sportsbook will mail an IRS form W-2G to the customer completed for each qualifying wager.

Tap the three-line Menu icon in the top right corner. They calculate ending balance - beginning balance - deposits. If you strike lucky and you take home a net profit of 600 or more for the year playing in sportsbooks such as DraftKings the operators have a legal duty to send both yourself and the IRS a Form 1099 -MISC.

To access the Document Center via mobile web. 2021 Where can I find my DraftKings tax forms documents 1099 W-2G. Below Tax Center tap Download Tax Documents.

Tap your profile photo in the top left corner. Fantasy Sportsbook Casino Marketplace. If you showed a profit of 1 to 599 during a calendar year you will probably not be issued a 1099 by DraftKings FanDuel or any other daily fantasy sports site.

Find the sport and outcome you want to bet on. This is my first year with sportsbooks but for DFS you are only taxed on net profit. Place a bet and follow your games to bet live in-play as the action unfolds.

DraftKings has been granted an extension from the IRS and has been telling players since earlier this month that 1099 forms should arrive within 2-4 weeks.

Paying Tax On Your Sports Betting Profits Is Simple Kind Of

Draftkings Sportsbook Review Why It S The Best Online Sportsbook Crossing Broad

Paying Tax On Your Sports Betting Profits Is Simple Kind Of

Quick Answer Will Draftkings Sportsbook Send Me A 1099 Cheating Card Game

Draftkings Sportsbook Welcome Bonus Promo Code

Draftkings Ct Promo Code 2022 For 1 050 Bonus

Draftkings Sportsbook Promo Code May 22 1 000 Free Bet

Draftkings Ny Sportsbook Promo Code For Up To 1 050

Draftkings Tax Form 1099 Where To Find It How To Fill

Fantasy Sports Taxes Sports Betting Taxes Dfs Army

Draftkings Sportsbook Ohio The Best Sports Betting App Coming Soon

How To Pay Taxes On Sports Betting Winnings Bookies Com

Draftkings Canada Ontario Sportsbook App Promo Code

Draftkings Sportsbook Indiana App User Guide Promo Code

Draftkings Sportsbook Colorado A Phenomenal Sports Betting App

Draftkings Sportsbook Welcome Bonus Promo Code